Evaluating Trading Strategies: Beyond Metrics and Into the Mind

Evaluating a trading strategy isn’t just about stats. It’s about the psychological fit, the drawdowns you can handle, and how your lifestyle aligns with the trading routine. Here's my framework for evaluating a strategy you can actually stick to.

Most posts about evaluating trading strategies delve into metrics such as Sharpe ratios, Sortino ratios, or profit factors. While those are important, this post isn’t about them.

This is about finding a strategy-personality fit.

You can have a profitable strategy on paper, but if it doesn’t align with your mindset, schedule, or psychology, you will abandon it during drawdowns or, worse, break its rules and sabotage it.

Let’s delve deeper into how I evaluate a trading strategy, not just for its performance, but also for its practical applicability in real-life scenarios.

📌 Note: This post complements another one I wrote titled "The Accuracy Trap", which explores how high win-rate strategies can still fail if they lack proper reward-to-risk ratios. While that post warns against over-focusing on accuracy, this one emphasizes finding the sweet spot between statistical viability and personal comfort—what I call strategy-personality fit.

1. Win Rate vs. Frequency: What Do You Need?

When evaluating win rate, context is everything.

A 30% win rate with a 3:1 or higher reward-to-risk might be fine if you take five trades or more every day. But if you take just one trade a day, 30% can "feel like" you're wrong most of the time - even though you are not. It's just that the length of time between wins can wear you down. It still requires psychological readiness to sit through frequent losses while waiting for those occasional big wins.

I prefer strategies that offer (minimum) 35–40% win rates, especially when I take 2–3 trades within a predictable timeframe, like the first two hours of the market.

“Low win rate, high reward” strategies may look statistically significant on paper, but can break your will in real life, especially if you miss one big win or can’t handle long streaks of losses.

2. Strategy Lifestyle Compatibility

Before going deeper into metrics and numbers, I ask:

- Can I even live with this strategy? Does the profit curve look acceptable?

- Will the signals show up at 2 AM? Am I willing to wake up to an alert?

- Do I need to monitor charts for 6 hours a day or 12 hours a day?

- Do I even like discretionary (non-systematic) setups?

If I can't follow the lifestyle the strategy demands, it's a mismatch- no matter how profitable it appears on paper.

Automation helps, but even then, I must ask:

- Will I interfere after three losing trades?

- Will I second-guess the system if I see early drawdowns?

If so, I either need to adjust the strategy or adjust my expectations.

Let us look at some profit curves for example over a year of backtest

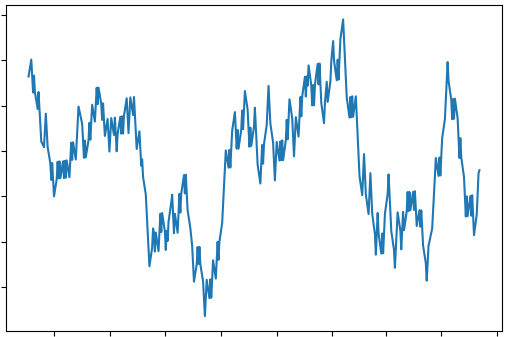

The first one above will not generate consistent returns, but it does experience periods of profit-making, only to lose it all. It stays around breakeven. Rare use - if any at all.

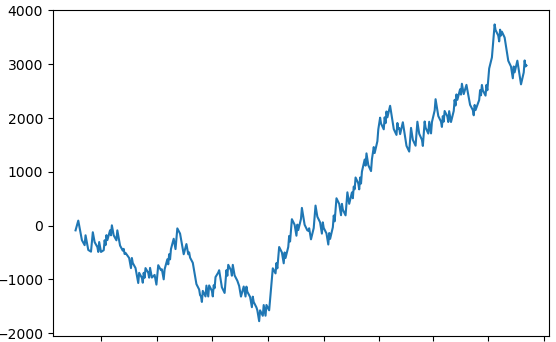

The second one is profitable, but it spends a few months in drawdown. The question is - am I okay with losing for a few months? It also has larger dips. It is usable, but I would look for something better. I am not comfortable with multiple months of seeing no progress; I would be more inclined to quit the strategy.

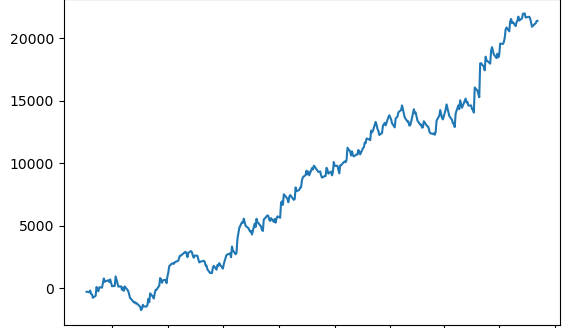

The third one is stable. This has a larger drawdown, too, but these drawdowns tend to be quicker compared to the previous one. There are a couple of months where it stays sideways to a small drawdown. Something that I will be more willing to deploy unless I find something better.

3. Profit Curves and Psychological Drawdowns

A rising profit curve means little if it hides a gut-wrenching drawdown in the middle.

If the max drawdown of a strategy is something you can't stomach, the strategy is incompatible.

I recall seeing a profit curve shared by a trading strategy guru - everything initially appeared to be an upward slope. But hidden within was a massive dip: a single drawdown that was as large as months of gains. It was visually deceptive and psychologically brutal. That one curve told me everything I needed to know about whether I could use such a strategy. The numbers might check out, but if I can’t handle the visual and emotional hit of that drop, it’s not a fit for me.

Drawdown isn’t just a number; it’s a test of your psychological endurance and risk parameters.

Ask yourself: What if I had started trading right near the peak before that drawdown? If you cannot stomach and survive the drawdown, that strategy isn't the right fit—or may be something you only use with a tiny position size.

Another critical question to ask: "How often does this largest drawdown occur?" If it is not often, the strategy and profit curve may still look usable.

Even if the historical max drawdown was 13 trades, remember: future performance can go worse. Always pad for a buffer.

Your psychology must align with the worst aspects of the strategy, not just the best.

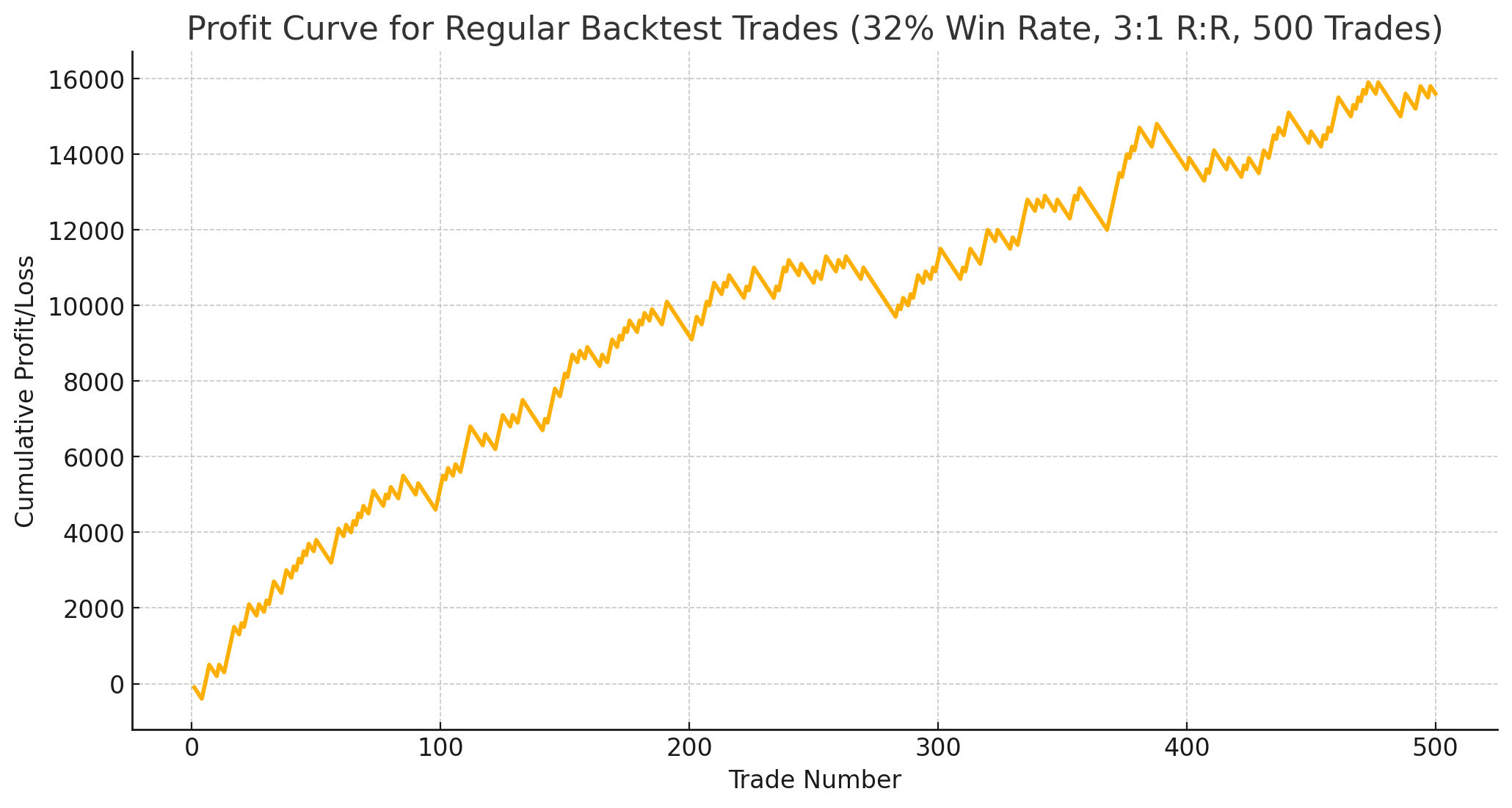

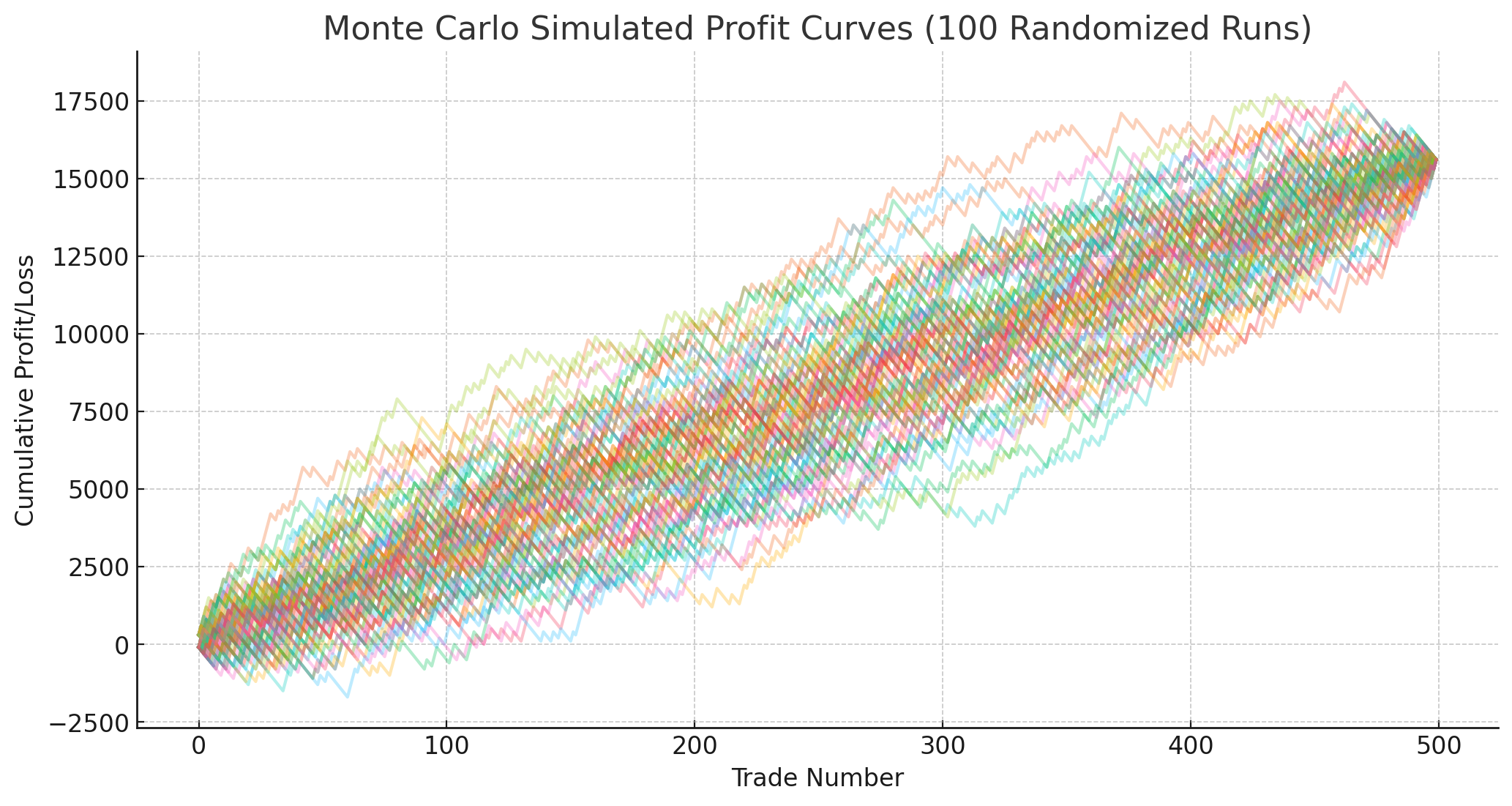

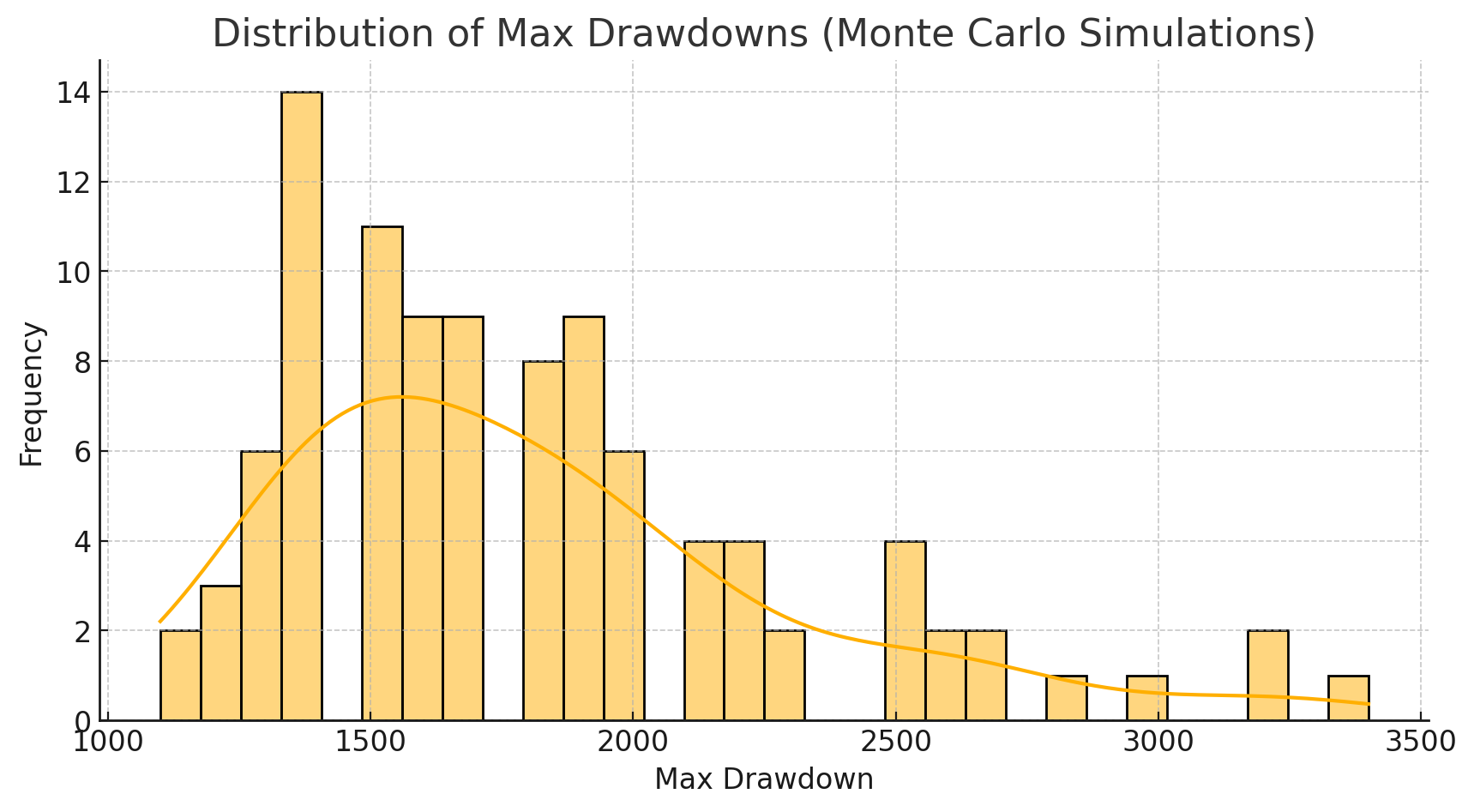

4. Monte Carlo Simulations: Stress Testing the Profit Curve

Backtesting gives a straight-line story, but life doesn’t work that way.

I take my backtest trades and randomize their order multiple times, like the Monte Carlo simulations, to estimate a secondary worst-case drawdown.

This reveals:

- The average drawdown

- The worst-case drawdown across permutations

Once I get this, I add a buffer (~30%) and calculate the risk capital needed. And remember that it is the risk capital, which could completely go to zero when drawdowns exceed the estimated parameters.

If my worst-case drawdown is $2,000, I might allocate $2,600, plus the risk of one additional trade (~$200), totaling $2,800 per unit position size. Or maybe round it to $3,000 per unit position size.

5. Capital Allocation & Sizing

Let's assume that this was with 1 MNQ. So, now that I have $3,000 that I can afford to lose - aka risk capital, then I can trade this strategy with 1 MNQ. If it were $6,000, I could increase the position size to 2 MNQ and so on until I hit a risk feasibility and appetite limit.

This provides me with a positioning ladder based on drawdown awareness, rather than gut feel.

NOTE: This is not your standard 1-2% risk per trade calculation. And this is not the margin capital. The deployed risk capital is the maximum amount you are willing to lose over multiple trades that may span days, months, or years, until the strategy fails. The margin requirements may exceed the risk capital.

6. Max Consecutive Losses & Wins

You'll need to know what your strategy is capable of.

Knowing what the max consecutive loss is will give you the confidence to take the trade even when a losing streak starts. Most people cannot stomach 10 consecutive losses. But when you know that the maximum number of consecutive losses your strategy tends to give is 10, you will be able to take the 11th trade with confidence. Knowing this statistical value allows you to pre-determine whether this is the strategy you are willing to use.

Gambler's fallacy: If your max-consecutive loss value is 11, and the strategy has a 40% win rate, it does not guarantee that the twelfth trade is going to be a profit. Assuming it's going to win, without a good statistical strategy, is a form of the gambler's fallacy. The probability for each trade is independent.

When things are going better than expected, it's easy to ignore the statistics. Observing the max consecutive wins can alert you to regime changes. If you suddenly see five wins where the maximum was four, something has changed - possibly the market or the strategy's behavior.

It's convenient to focus only on the max consecutive losses and treat wins as mere bonuses, but ignoring unusually long win streaks means ignoring that your strategy has broken out of its known shell. It does not warrant immediate action; it should definitely raise a warning flag. Something has shifted, and it deserves closer observation.

7. Daily/Weekly/Monthly Profitability Days

I track how many profitable days per week or month the strategy yields.

This isn’t a strong signal, but it helps psychologically. Even in a losing month, I need some winning days to stay engaged. However, that may not be the case for you.

Same with negative months per year. If I know I might lose 2 months out of 12, I am prepared to deal with it. Similarly, after a couple of large winning months, the expectation of a losing month increases. But these do not warrant changing position sizes without statistical validation.

8. Automation & Psychological Buffering

With automated trading, things improve slightly. You have offloaded your psychological workload—unless you watch the automation like a hawk.

Automation without emotional detachment is just a manual trader with a dashboard.

For automated systems or systematic manual trading, the key is parameter monitoring. The questions to ask are like this:

- Is the strategy within the expected drawdown?

- Has it breached the maximum number of consecutive losses and any buffer?

- Has it breached its maximum drawdown?

Once the strategy breach is revealed, whether positively or negatively, it warrants action. The action may be to allow it to run for a little longer, or reduce the position size, or pause the strategy, or discard it for the time being. Market regime changes can cause this.

If not, please trust the system.

Final Thoughts

This post is not about finding the most profitable system.

It’s about finding a strategy you can live with.

Backtest data tells you what might happen.

Psychology decides whether you stick through it.

Don’t optimize for just the peak equity. Optimize for the emotional valley, and optimize to survive and grow steadily.